User login

The average debt of graduating medical students today is $190,000, which has increased from $32,000 since 1986 (or the equivalent of $70,000 in 2017 dollars when adjusted for inflation).1 This fact is especially disconcerting given that medical trainees and professionals are not known for being financially sophisticated, and rising levels of high-interest educational debt, increasing years of training, and stagnant or decreasing physician salaries make this status quo untenable.2 Building foundational financial literacy and establishing good financial practices should start during medical school and residency; these basics are a crucial component of long-term job satisfaction and professional resilience.

One prominent physician finance writer advocates that residents should consider the following 5 big-ticket financial steps: acquire life and disability insurance, open a Roth IRA, engage yearly in some type of financial education, and learn about billing and coding in your specialty.3 These exercises, except life insurance for a resident without dependents, are all nonnegotiable, yet alone are insufficient actions to build a solid financial foundation. The purpose of this article is to address additional steps every resident should take, including establishing a workable budget, learning how and why to calculate net worth yearly, determining what percentage of income to save for retirement and basic investing strategies, and managing student loans.

Establish a Workable Budget

Living on a budget is a form of reality acceptance. It may feel impossible to save or budget on a resident salary, but residents earn approximately the median US household income of $59,039, according to the US Census Bureau from September 2017.4,5 There are many tools that can be used to create a budget and to track monthly expenses. However, the simplest way to budget is to pay yourself first with automatic deductions to retirement and savings accounts as well as automated bill payments. Making a habit of reviewing all expenses at the end of every month allows you to see if expenditures remain aligned to your personal values and to reallocate funds for the upcoming month if they are not.

Calculate Net Worth Yearly

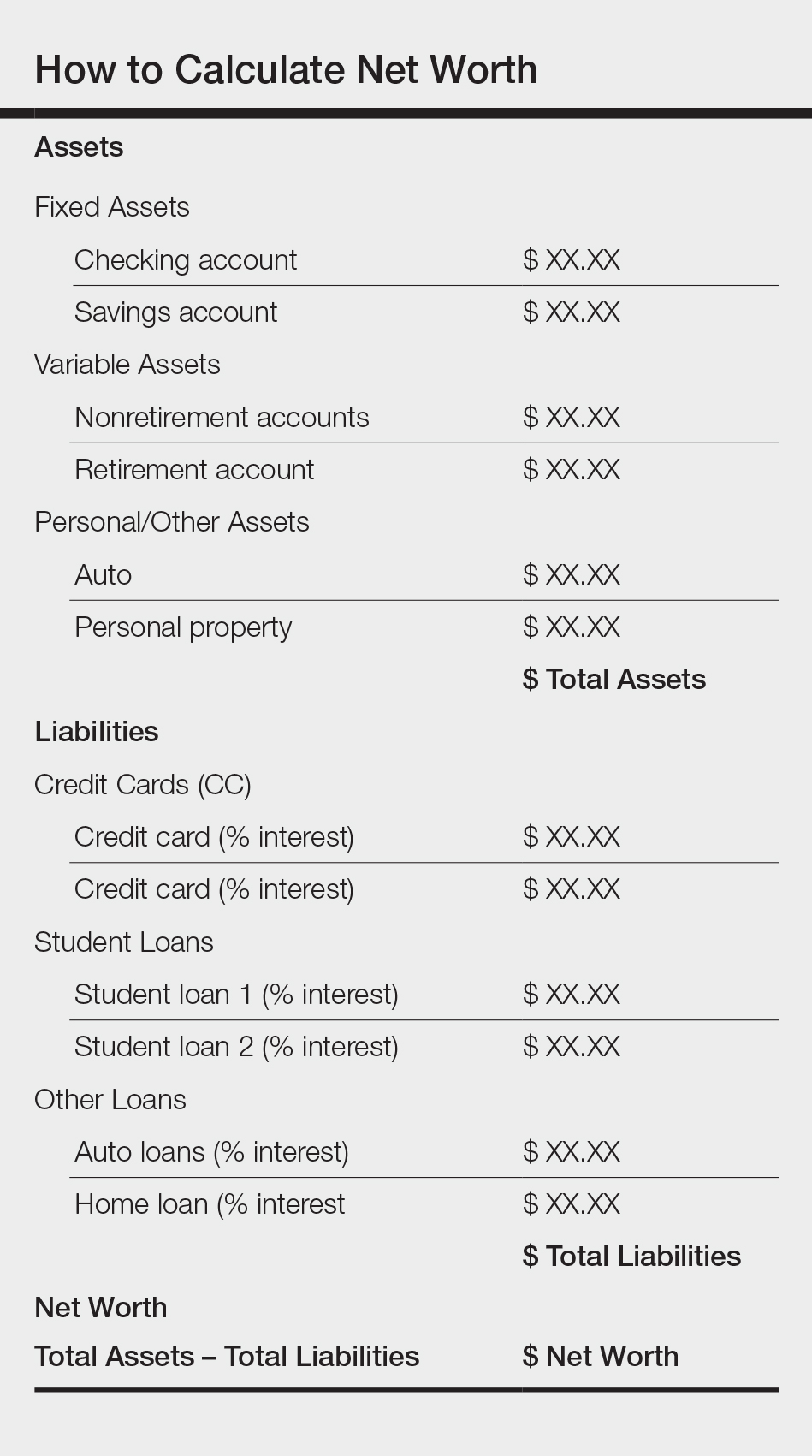

Calculating personal net worth may appear to be a discouraging activity to advocate for residents, as many will have a negative 6-figure net worth. The purpose is two-fold: Firstly, to compel you to become well acquainted with your varying types of debt and their respective interest rates. Secondly, similar to taking serial photographs of vitiligo patients to monitor for improvement, it may be the only thing in a long slow slog that indicates beneficial change is occurring because small daily efforts over time yield surprisingly impressive results and the calculation factors in both debt repayment and contributions to all savings vehicles. An example of a simplified method to calculate net worth is demonstrated in the Table.

Understand Your Retirement Account and Asset Distribution

Contributing to a retirement account should start day 1 of intern year. A simple rule of thumb to estimate how much money you need to save for retirement is to divide how much you expect to spend on a yearly basis by 4%. For example, if you anticipate spending $80,000 per year during retirement, you will need $2 million in savings (0.04×$2,000,000=$80,000). The amount saved depends on the aggressiveness of your financial goals, but it should be a minimum of 10% to 15% of income during residency and at least 20% afterwards. This strategy allows even a resident to save $25,000 to $50,000 over a 4-year period (depending on employer match), which can accrue additional value in the stock market. One advantage of contributing to an employer-based retirement account, which usually is a 403(b) plan for residents, is that it lowers your tax burden for the year because the savings are tax deferred, in contrast to a Roth IRA, which is funded with posttax dollars. Roth accounts often are recommended for residents because contributions are made during a period in which the physician is presumably in the lowest tax bracket, as account earnings and withdrawals from a Roth IRA after 59.5 years of age, when most physicians expect to be in a higher tax bracket, are tax free. Another advantage of contributing to a 403(b) account is that many residency programs offer a match, which provides for an immediate and substantial return on invested money. Because most residents do not have the cash flow to fully fund both a Roth IRA and 403(b) account (2018 contribution limits are $5500 and $18,500, respectively),6,7 one strategy to utilize both is to save enough to the 403(b) to capture the employer match and place whatever additional savings you can afford into the Roth IRA.

Many different investment strategies exist, and a thorough discussion of them is beyond the scope of this article. Simply speaking, there are 4 major asset classes in which to invest: US stocks, foreign stocks, real estate, and bonds. The variation of recommended contributions to each asset is limitless, and every resident should spend time considering the best strategy for his/her goals. One example of a simple effective investing strategy is to utilize index funds, which track the market and therefore rise with the market, as they tend to go up (at least historically, though temporary setbacks occur).8 If you are investing in funds available through your employer-sponsored retirement account, examine the funds you are automatically assigned and their associated fee and expense ratio (ER) disclosures, which are typically available through the online portal. A general rule of thumb is that good funds have ERs of less than 0.5% and bad funds have ERs greater than 1% and additional associated fees. The funds available to you also can be researched on the Morningstar, Inc, website (www.morningstar.com). My institution (University of Texas Dell Medical School, Austin) offers a variety of options with ERs varying from 0.02% to 1.02%. The difference in the costs associated with these funds over decades is notable, and it pays (literally) to understand the nuances. Reallocation of funds usually can be done easily online and are effective within 24 hours.

Student Loans

Although many residents agonize most over management of student loans, the simple solution is do not defer them. Refinancing federal loans with a private company versus enrolling in an income-based repayment program depends on many factors, including whether you have a high-earning spouse, how many dependents you have, and whether you expect to stay in academia and will be eligible for Public Service Loan Forgiveness, among others. Look critically at your situation and likely future employment to decide what is most appropriate for you; doing so can save you thousands of dollars in interest over the course of your residency.

Final Thoughts

To the detriment of residents and the attending physicians they will become, discussing financial matters in medicine remains rare, perhaps because it seems to shift what should be the singular focus of our profession, namely to help the sick, to thoughts of personal gain, which is a false dichotomy. Unquestionably, the physician’s role that supersedes all others is to care for the patient and to honor the oath we all took: “Into whatsoever houses I enter, I will enter to help the sick.” But this commitment should not preclude the mastery of financial concepts that promote personal and professional health and well-being. After all, the joy in work is maximized when you are not enslaved to it.

Your reading assignment, paper revision, or presentation can wait. Making time to understand your current financial health, to build your own financial literacy, and to plan for your future is an important component of a long satisfying career. Start now.

- Grischkan J, George BP, Chaiyachati K, et al. Distribution of medical education debt by specialty, 2010-2016. JAMA Intern Med. 2017;177:1532-1535.

- Ahmad FA, White AJ, Hiller KM, et al. An assessment of residents’ and fellows’ personal finance literacy: an unmet medical education need. Int J Med Educ. 2017;8:192-204.

- The five big money items you should do as a resident. The White Coat Investor website. https://www.whitecoatinvestor.com/the-five-big-money-items-you-should-do-as-a-resident. Published July 7, 2011. Accessed May 14, 2018.

- Income, poverty and health insurance coverage in the United States: 2016. United States Census Bureau website. https://www.census.gov/newsroom/press-releases/2017/income-povery.html. Published September 12, 2017. Accessed May 14, 2018.

- Levy S. Residents salary and debt report 2017. Medscape website. https://www.medscape.com/slideshow/residents-salary-and-debt-report-2017-6008931. Published July 26, 2017. Accessed May 22, 2018.

- Retirement topics - IRA contribution limits. Internal Revenue Service website. https://www.irs.gov/retirement-plans/plan-participant-employee/retirement-topics-ira-contribution-limits. Updated October 20, 2017. Accessed May 22, 2018.

- Retirement plan FAQs regarding 403(b) tax-sheltered annuity plans. Internal Revenue Service website. https://www.irs.gov/retirement-plans/retirement-plans-faqs-regarding-403b-tax-sheltered-annuity-plans#conts. Updated November 14, 2017. Accessed May 22, 2018.

- Collins JL. Stock series. JLCollins website. http://jlcollinsnh.com/stock-series/. Accessed May 14, 2018.

The average debt of graduating medical students today is $190,000, which has increased from $32,000 since 1986 (or the equivalent of $70,000 in 2017 dollars when adjusted for inflation).1 This fact is especially disconcerting given that medical trainees and professionals are not known for being financially sophisticated, and rising levels of high-interest educational debt, increasing years of training, and stagnant or decreasing physician salaries make this status quo untenable.2 Building foundational financial literacy and establishing good financial practices should start during medical school and residency; these basics are a crucial component of long-term job satisfaction and professional resilience.

One prominent physician finance writer advocates that residents should consider the following 5 big-ticket financial steps: acquire life and disability insurance, open a Roth IRA, engage yearly in some type of financial education, and learn about billing and coding in your specialty.3 These exercises, except life insurance for a resident without dependents, are all nonnegotiable, yet alone are insufficient actions to build a solid financial foundation. The purpose of this article is to address additional steps every resident should take, including establishing a workable budget, learning how and why to calculate net worth yearly, determining what percentage of income to save for retirement and basic investing strategies, and managing student loans.

Establish a Workable Budget

Living on a budget is a form of reality acceptance. It may feel impossible to save or budget on a resident salary, but residents earn approximately the median US household income of $59,039, according to the US Census Bureau from September 2017.4,5 There are many tools that can be used to create a budget and to track monthly expenses. However, the simplest way to budget is to pay yourself first with automatic deductions to retirement and savings accounts as well as automated bill payments. Making a habit of reviewing all expenses at the end of every month allows you to see if expenditures remain aligned to your personal values and to reallocate funds for the upcoming month if they are not.

Calculate Net Worth Yearly

Calculating personal net worth may appear to be a discouraging activity to advocate for residents, as many will have a negative 6-figure net worth. The purpose is two-fold: Firstly, to compel you to become well acquainted with your varying types of debt and their respective interest rates. Secondly, similar to taking serial photographs of vitiligo patients to monitor for improvement, it may be the only thing in a long slow slog that indicates beneficial change is occurring because small daily efforts over time yield surprisingly impressive results and the calculation factors in both debt repayment and contributions to all savings vehicles. An example of a simplified method to calculate net worth is demonstrated in the Table.

Understand Your Retirement Account and Asset Distribution

Contributing to a retirement account should start day 1 of intern year. A simple rule of thumb to estimate how much money you need to save for retirement is to divide how much you expect to spend on a yearly basis by 4%. For example, if you anticipate spending $80,000 per year during retirement, you will need $2 million in savings (0.04×$2,000,000=$80,000). The amount saved depends on the aggressiveness of your financial goals, but it should be a minimum of 10% to 15% of income during residency and at least 20% afterwards. This strategy allows even a resident to save $25,000 to $50,000 over a 4-year period (depending on employer match), which can accrue additional value in the stock market. One advantage of contributing to an employer-based retirement account, which usually is a 403(b) plan for residents, is that it lowers your tax burden for the year because the savings are tax deferred, in contrast to a Roth IRA, which is funded with posttax dollars. Roth accounts often are recommended for residents because contributions are made during a period in which the physician is presumably in the lowest tax bracket, as account earnings and withdrawals from a Roth IRA after 59.5 years of age, when most physicians expect to be in a higher tax bracket, are tax free. Another advantage of contributing to a 403(b) account is that many residency programs offer a match, which provides for an immediate and substantial return on invested money. Because most residents do not have the cash flow to fully fund both a Roth IRA and 403(b) account (2018 contribution limits are $5500 and $18,500, respectively),6,7 one strategy to utilize both is to save enough to the 403(b) to capture the employer match and place whatever additional savings you can afford into the Roth IRA.

Many different investment strategies exist, and a thorough discussion of them is beyond the scope of this article. Simply speaking, there are 4 major asset classes in which to invest: US stocks, foreign stocks, real estate, and bonds. The variation of recommended contributions to each asset is limitless, and every resident should spend time considering the best strategy for his/her goals. One example of a simple effective investing strategy is to utilize index funds, which track the market and therefore rise with the market, as they tend to go up (at least historically, though temporary setbacks occur).8 If you are investing in funds available through your employer-sponsored retirement account, examine the funds you are automatically assigned and their associated fee and expense ratio (ER) disclosures, which are typically available through the online portal. A general rule of thumb is that good funds have ERs of less than 0.5% and bad funds have ERs greater than 1% and additional associated fees. The funds available to you also can be researched on the Morningstar, Inc, website (www.morningstar.com). My institution (University of Texas Dell Medical School, Austin) offers a variety of options with ERs varying from 0.02% to 1.02%. The difference in the costs associated with these funds over decades is notable, and it pays (literally) to understand the nuances. Reallocation of funds usually can be done easily online and are effective within 24 hours.

Student Loans

Although many residents agonize most over management of student loans, the simple solution is do not defer them. Refinancing federal loans with a private company versus enrolling in an income-based repayment program depends on many factors, including whether you have a high-earning spouse, how many dependents you have, and whether you expect to stay in academia and will be eligible for Public Service Loan Forgiveness, among others. Look critically at your situation and likely future employment to decide what is most appropriate for you; doing so can save you thousands of dollars in interest over the course of your residency.

Final Thoughts

To the detriment of residents and the attending physicians they will become, discussing financial matters in medicine remains rare, perhaps because it seems to shift what should be the singular focus of our profession, namely to help the sick, to thoughts of personal gain, which is a false dichotomy. Unquestionably, the physician’s role that supersedes all others is to care for the patient and to honor the oath we all took: “Into whatsoever houses I enter, I will enter to help the sick.” But this commitment should not preclude the mastery of financial concepts that promote personal and professional health and well-being. After all, the joy in work is maximized when you are not enslaved to it.

Your reading assignment, paper revision, or presentation can wait. Making time to understand your current financial health, to build your own financial literacy, and to plan for your future is an important component of a long satisfying career. Start now.

The average debt of graduating medical students today is $190,000, which has increased from $32,000 since 1986 (or the equivalent of $70,000 in 2017 dollars when adjusted for inflation).1 This fact is especially disconcerting given that medical trainees and professionals are not known for being financially sophisticated, and rising levels of high-interest educational debt, increasing years of training, and stagnant or decreasing physician salaries make this status quo untenable.2 Building foundational financial literacy and establishing good financial practices should start during medical school and residency; these basics are a crucial component of long-term job satisfaction and professional resilience.

One prominent physician finance writer advocates that residents should consider the following 5 big-ticket financial steps: acquire life and disability insurance, open a Roth IRA, engage yearly in some type of financial education, and learn about billing and coding in your specialty.3 These exercises, except life insurance for a resident without dependents, are all nonnegotiable, yet alone are insufficient actions to build a solid financial foundation. The purpose of this article is to address additional steps every resident should take, including establishing a workable budget, learning how and why to calculate net worth yearly, determining what percentage of income to save for retirement and basic investing strategies, and managing student loans.

Establish a Workable Budget

Living on a budget is a form of reality acceptance. It may feel impossible to save or budget on a resident salary, but residents earn approximately the median US household income of $59,039, according to the US Census Bureau from September 2017.4,5 There are many tools that can be used to create a budget and to track monthly expenses. However, the simplest way to budget is to pay yourself first with automatic deductions to retirement and savings accounts as well as automated bill payments. Making a habit of reviewing all expenses at the end of every month allows you to see if expenditures remain aligned to your personal values and to reallocate funds for the upcoming month if they are not.

Calculate Net Worth Yearly

Calculating personal net worth may appear to be a discouraging activity to advocate for residents, as many will have a negative 6-figure net worth. The purpose is two-fold: Firstly, to compel you to become well acquainted with your varying types of debt and their respective interest rates. Secondly, similar to taking serial photographs of vitiligo patients to monitor for improvement, it may be the only thing in a long slow slog that indicates beneficial change is occurring because small daily efforts over time yield surprisingly impressive results and the calculation factors in both debt repayment and contributions to all savings vehicles. An example of a simplified method to calculate net worth is demonstrated in the Table.

Understand Your Retirement Account and Asset Distribution

Contributing to a retirement account should start day 1 of intern year. A simple rule of thumb to estimate how much money you need to save for retirement is to divide how much you expect to spend on a yearly basis by 4%. For example, if you anticipate spending $80,000 per year during retirement, you will need $2 million in savings (0.04×$2,000,000=$80,000). The amount saved depends on the aggressiveness of your financial goals, but it should be a minimum of 10% to 15% of income during residency and at least 20% afterwards. This strategy allows even a resident to save $25,000 to $50,000 over a 4-year period (depending on employer match), which can accrue additional value in the stock market. One advantage of contributing to an employer-based retirement account, which usually is a 403(b) plan for residents, is that it lowers your tax burden for the year because the savings are tax deferred, in contrast to a Roth IRA, which is funded with posttax dollars. Roth accounts often are recommended for residents because contributions are made during a period in which the physician is presumably in the lowest tax bracket, as account earnings and withdrawals from a Roth IRA after 59.5 years of age, when most physicians expect to be in a higher tax bracket, are tax free. Another advantage of contributing to a 403(b) account is that many residency programs offer a match, which provides for an immediate and substantial return on invested money. Because most residents do not have the cash flow to fully fund both a Roth IRA and 403(b) account (2018 contribution limits are $5500 and $18,500, respectively),6,7 one strategy to utilize both is to save enough to the 403(b) to capture the employer match and place whatever additional savings you can afford into the Roth IRA.

Many different investment strategies exist, and a thorough discussion of them is beyond the scope of this article. Simply speaking, there are 4 major asset classes in which to invest: US stocks, foreign stocks, real estate, and bonds. The variation of recommended contributions to each asset is limitless, and every resident should spend time considering the best strategy for his/her goals. One example of a simple effective investing strategy is to utilize index funds, which track the market and therefore rise with the market, as they tend to go up (at least historically, though temporary setbacks occur).8 If you are investing in funds available through your employer-sponsored retirement account, examine the funds you are automatically assigned and their associated fee and expense ratio (ER) disclosures, which are typically available through the online portal. A general rule of thumb is that good funds have ERs of less than 0.5% and bad funds have ERs greater than 1% and additional associated fees. The funds available to you also can be researched on the Morningstar, Inc, website (www.morningstar.com). My institution (University of Texas Dell Medical School, Austin) offers a variety of options with ERs varying from 0.02% to 1.02%. The difference in the costs associated with these funds over decades is notable, and it pays (literally) to understand the nuances. Reallocation of funds usually can be done easily online and are effective within 24 hours.

Student Loans

Although many residents agonize most over management of student loans, the simple solution is do not defer them. Refinancing federal loans with a private company versus enrolling in an income-based repayment program depends on many factors, including whether you have a high-earning spouse, how many dependents you have, and whether you expect to stay in academia and will be eligible for Public Service Loan Forgiveness, among others. Look critically at your situation and likely future employment to decide what is most appropriate for you; doing so can save you thousands of dollars in interest over the course of your residency.

Final Thoughts

To the detriment of residents and the attending physicians they will become, discussing financial matters in medicine remains rare, perhaps because it seems to shift what should be the singular focus of our profession, namely to help the sick, to thoughts of personal gain, which is a false dichotomy. Unquestionably, the physician’s role that supersedes all others is to care for the patient and to honor the oath we all took: “Into whatsoever houses I enter, I will enter to help the sick.” But this commitment should not preclude the mastery of financial concepts that promote personal and professional health and well-being. After all, the joy in work is maximized when you are not enslaved to it.

Your reading assignment, paper revision, or presentation can wait. Making time to understand your current financial health, to build your own financial literacy, and to plan for your future is an important component of a long satisfying career. Start now.

- Grischkan J, George BP, Chaiyachati K, et al. Distribution of medical education debt by specialty, 2010-2016. JAMA Intern Med. 2017;177:1532-1535.

- Ahmad FA, White AJ, Hiller KM, et al. An assessment of residents’ and fellows’ personal finance literacy: an unmet medical education need. Int J Med Educ. 2017;8:192-204.

- The five big money items you should do as a resident. The White Coat Investor website. https://www.whitecoatinvestor.com/the-five-big-money-items-you-should-do-as-a-resident. Published July 7, 2011. Accessed May 14, 2018.

- Income, poverty and health insurance coverage in the United States: 2016. United States Census Bureau website. https://www.census.gov/newsroom/press-releases/2017/income-povery.html. Published September 12, 2017. Accessed May 14, 2018.

- Levy S. Residents salary and debt report 2017. Medscape website. https://www.medscape.com/slideshow/residents-salary-and-debt-report-2017-6008931. Published July 26, 2017. Accessed May 22, 2018.

- Retirement topics - IRA contribution limits. Internal Revenue Service website. https://www.irs.gov/retirement-plans/plan-participant-employee/retirement-topics-ira-contribution-limits. Updated October 20, 2017. Accessed May 22, 2018.

- Retirement plan FAQs regarding 403(b) tax-sheltered annuity plans. Internal Revenue Service website. https://www.irs.gov/retirement-plans/retirement-plans-faqs-regarding-403b-tax-sheltered-annuity-plans#conts. Updated November 14, 2017. Accessed May 22, 2018.

- Collins JL. Stock series. JLCollins website. http://jlcollinsnh.com/stock-series/. Accessed May 14, 2018.

- Grischkan J, George BP, Chaiyachati K, et al. Distribution of medical education debt by specialty, 2010-2016. JAMA Intern Med. 2017;177:1532-1535.

- Ahmad FA, White AJ, Hiller KM, et al. An assessment of residents’ and fellows’ personal finance literacy: an unmet medical education need. Int J Med Educ. 2017;8:192-204.

- The five big money items you should do as a resident. The White Coat Investor website. https://www.whitecoatinvestor.com/the-five-big-money-items-you-should-do-as-a-resident. Published July 7, 2011. Accessed May 14, 2018.

- Income, poverty and health insurance coverage in the United States: 2016. United States Census Bureau website. https://www.census.gov/newsroom/press-releases/2017/income-povery.html. Published September 12, 2017. Accessed May 14, 2018.

- Levy S. Residents salary and debt report 2017. Medscape website. https://www.medscape.com/slideshow/residents-salary-and-debt-report-2017-6008931. Published July 26, 2017. Accessed May 22, 2018.

- Retirement topics - IRA contribution limits. Internal Revenue Service website. https://www.irs.gov/retirement-plans/plan-participant-employee/retirement-topics-ira-contribution-limits. Updated October 20, 2017. Accessed May 22, 2018.

- Retirement plan FAQs regarding 403(b) tax-sheltered annuity plans. Internal Revenue Service website. https://www.irs.gov/retirement-plans/retirement-plans-faqs-regarding-403b-tax-sheltered-annuity-plans#conts. Updated November 14, 2017. Accessed May 22, 2018.

- Collins JL. Stock series. JLCollins website. http://jlcollinsnh.com/stock-series/. Accessed May 14, 2018.