User login

Navigating the Search for a Financial Adviser

As gastroenterologists, we spend innumerable years in medical training with an abrupt and significant increase in our earning potential upon beginning practice. The majority of us also carry a sizeable amount of student loan debt. This combination results in a unique situation that can make us hesitant about how best to set ourselves up financially while also making us vulnerable to potentially predatory financial practices.

Although your initial steps to achieve financial wellness and build wealth can be obtained on your own with some education, a financial adviser becomes indispensable when you have significant assets, a high income, complex finances, and/or are experiencing a major life change. Additionally, as there are so many avenues to invest and grow your capital, a financial adviser can assist in designing a portfolio to best accomplish specific monetary goals. Studies have demonstrated that those working with a financial adviser reduce their single-stock risk and have more significant increase in portfolio value, reducing the total cost associated with their investments’ management.1 Those working with a financial adviser will also net up to a 3% larger annual return, compared with a standard baseline investment plan.2,3

Based on this information, it may appear that working with a personal financial adviser would be a no-brainer. Unfortunately, there is a caveat: There is no legal regulation regarding who can use the title “financial adviser.” It is therefore crucial to be aware of common practices and terminology to best help you identify a reputable financial adviser and reduce your risk of excessive fees or financial loss. This is also a highly personal decision and your search should first begin with understanding why you are looking for an adviser, as this will determine the appropriate type of service to look for.

Types of Advisers

A certified financial planner (CFP) is an expert in estate planning, taxes, retirement saving, and financial planning who has a formal designation by the Certified Financial Planner Board of Standards Inc.4 They must undergo stringent licensing examinations following a 3-year course with required continuing education to maintain their credentials. CFPs are fiduciaries, meaning they must make financial decisions in your best interest, even if they may make less money with that product or investment strategy. In other words, they are beholden to give honest, impartial recommendations to their clients, and may face sanctions by the CFP Board if found to violate its Code of Ethics and Standards of Conduct, which includes failure to act in a fiduciary duty.5

CFPs evaluate your total financial picture, such as investments, insurance policies, and overall current financial position, to develop a comprehensive strategy that will successfully guide you to your financial goal. There are many individuals who may refer to themselves as financial planners without having the CFP designation; while they may offer similar services as above, they will not be required to act as a fiduciary. Hence, it is important to do your due diligence and verify they hold this certification via the CFP Board website: www.cfp.net/verify-a-cfp-professional.

An investment adviser is a legal term from the U.S. Securities and Exchange Commission (SEC) and the Financial Industry Regulatory Authority (FINRA) referring to an individual who provides recommendations and analyses for financial securities such as stock. Both of these agencies ensure investment advisers adhere to regulatory requirements designed to protect client investers. Similar to CFPs, they are held to a fiduciary standard, and their firm is required to register with the SEC or the state of practice based on the amount of assets under management.6

An individual investment adviser must also register with their state as an Investment Adviser Representative (IAR), the distinctive term referring to an individual as opposed to an investment advising firm. Investment advisers are required to pass the extensive Series 65, Uniform Investment Advisor Law Exam, or equivalent, by states requiring licensure.7 They can guide you on the selection of particular investments and portfolio management based on a discussion with you regarding your current financial standing and what fiscal ambitions you wish to achieve.

A financial adviser provides direction on a multitude of financially related topics such as investing, tax laws, and life insurance with the goal to help you reach specific financial objectives. However, this term is often used quite ubiquitously given the lack of formal regulation of the title. Essentially, those with varying types of educational background can give themselves the title of financial adviser.

If a financial adviser buys or sells financial securities such as stocks or bonds, then they must be registered as a licensed broker with the SEC and IAR and pass the Series 6 or Series 7 exam. Unlike CFPs and investment advisers, a financial adviser (if also a licensed broker) is not required to be a fiduciary, and instead works under the suitability standard.8 Suitability requires that financial recommendations made by the adviser are appropriate but not necessarily the best for the client. In fact, these recommendations do not even have to be the most suitable. This is where conflicts of interest can arise with the adviser recommending products and securities that best compensate them while not serving the best return on investment for you.

Making the search for a financial adviser more complex, an individual can be a combination of any of the above, pending the appropriate licensing. For example, a CFP can also be an asset manager and thus hold the title of a financial adviser and/or IAR. A financial adviser may also not directly manage your assets if they have a partnership with a third party or another licensed individual. Questions to ask of your potential financial adviser should therefore include the following:

- What licensure and related education do you have?

- What is your particular area of expertise?

- How long have you been in practice?

- How will you be managing my assets?

Financial Adviser Fee Schedules

Prior to working with a financial adviser, you must also inquire about their fee structure. There are two kinds of fee schedules used by financial advisers: fee-only and fee-based.

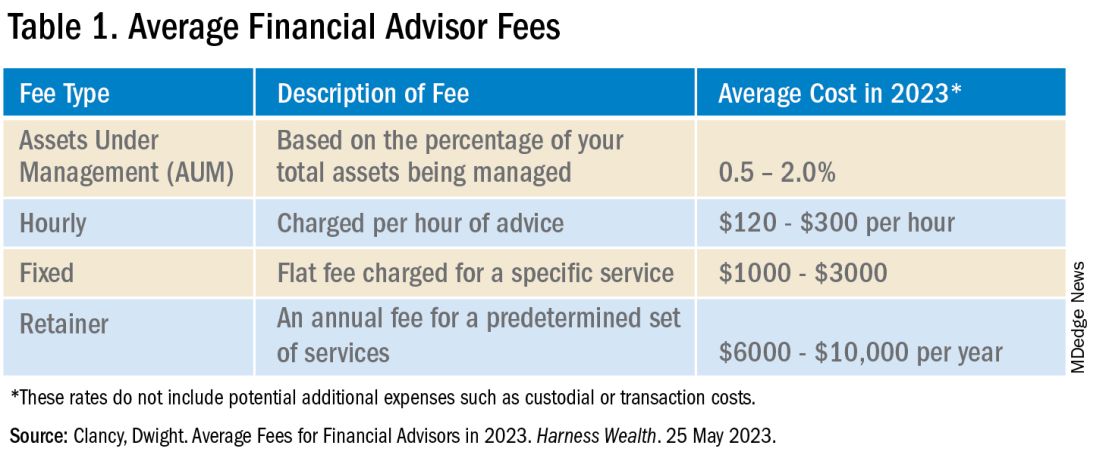

Fee-only advisers receive payment solely for the services they provide. They do not collect commissions from third parties providing the recommended products. There is variability in how this type of payment schedule is structured, encompassing flat fees, hourly rates, or the adviser charging a retainer. The Table below compares the types of fee-only structures and range of charges based on 2023 rates.9 Of note, fee-only advisers serve as fiduciaries.10

Fee-based financial advisers receive payment for services but may also receive commission on specific products they sell to you.9 Most, if not all, financial experts recommend avoiding advisers using commission-based charges given the potential conflict of interest: How can one be absolutely sure this recommended financial product is best for you, knowing your adviser has a financial stake in said item?

In addition to charging the fees above, your financial adviser, if they are actively managing your investment portfolio, will also charge an assets under management (AUM) fee. This is a percentage of the dollar amount within your portfolio. For example, if your adviser charges a 1% AUM rate for your account totaling $100,000, this equates to a $1,000 fee in that calendar year. AUM fees typically decrease as the size of your portfolio increases. As seen in the Table, there is a wide range of the average AUM rate (0.5%–2%); however, an AUM fee approaching 2% is unnecessarily high and consumes a significant portion of your portfolio. Thus, it is recommended to look for a money manager with an approximate 1% AUM fee.

Many of us delay or avoid working with a financial adviser due to the potential perceived risks of having poor portfolio management from an adviser not working in our best interest, along with the concern for excessive fees. In many ways, it is how we counsel our patients. While they can seek medical information on their own, their best care is under the guidance of an expert: a healthcare professional. That being said, personal finance is indeed personal, so I hope this guide helps facilitate your search and increase your financial wellness.

Dr. Luthra is a therapeutic endoscopist at Moffitt Cancer Center, Tampa, Florida, and the founder of The Scope of Finance, a financial wellness education and coaching company focused on physicians. Her interest in financial well-being is thanks to the teachings of her father, an entrepreneur and former Certified Financial Planner (CFP). She can be found on Instagram (thescopeoffinance) and X (@ScopeofFinance). She reports no financial disclosures relevant to this article.

References

1. Pagliaro CA and Utkus SP. Assessing the value of advice. Vanguard. 2019 Sept.

2. Kinniry Jr. FM et al. Putting a value on your value: Quantifying Vanguard Advisor’s Alpha. Vanguard. 2022 July.

3. Horan S. What Are the Benefits of Working with a Financial Advisor? – 2021 Study. Smart Asset. 2023 July 27.

4. Kagan J. Certified Financial PlannerTM(CFP): What It Is and How to Become One. Investopedia. 2023 Aug 3.

5. CFP Board. Our Commitment to Ethical Standards. CFP Board. 2024.

6. Staff of the Investment Adviser Regulation Office Division of Investment Management, U.S. Securities and Exchange Commission. Regulation of Investment Advisers by the U.S. Securities and Exchange Commission. 2013 Mar.

7. Hicks C. Investment Advisor vs. Financial Advisor: There is a Difference. US News & World Report. 2019 June 13.

8. Roberts K. Financial advisor vs. financial planner: What is the difference? Bankrate. 2023 Nov 21.

9. Clancy D. Average Fees for Financial Advisors in 2023. Harness Wealth. 2023 May 25.

10. Palmer B. Fee- vs. Commission-Based Advisor: What’s the Difference? Investopedia. 2023 June 20.

As gastroenterologists, we spend innumerable years in medical training with an abrupt and significant increase in our earning potential upon beginning practice. The majority of us also carry a sizeable amount of student loan debt. This combination results in a unique situation that can make us hesitant about how best to set ourselves up financially while also making us vulnerable to potentially predatory financial practices.

Although your initial steps to achieve financial wellness and build wealth can be obtained on your own with some education, a financial adviser becomes indispensable when you have significant assets, a high income, complex finances, and/or are experiencing a major life change. Additionally, as there are so many avenues to invest and grow your capital, a financial adviser can assist in designing a portfolio to best accomplish specific monetary goals. Studies have demonstrated that those working with a financial adviser reduce their single-stock risk and have more significant increase in portfolio value, reducing the total cost associated with their investments’ management.1 Those working with a financial adviser will also net up to a 3% larger annual return, compared with a standard baseline investment plan.2,3

Based on this information, it may appear that working with a personal financial adviser would be a no-brainer. Unfortunately, there is a caveat: There is no legal regulation regarding who can use the title “financial adviser.” It is therefore crucial to be aware of common practices and terminology to best help you identify a reputable financial adviser and reduce your risk of excessive fees or financial loss. This is also a highly personal decision and your search should first begin with understanding why you are looking for an adviser, as this will determine the appropriate type of service to look for.

Types of Advisers

A certified financial planner (CFP) is an expert in estate planning, taxes, retirement saving, and financial planning who has a formal designation by the Certified Financial Planner Board of Standards Inc.4 They must undergo stringent licensing examinations following a 3-year course with required continuing education to maintain their credentials. CFPs are fiduciaries, meaning they must make financial decisions in your best interest, even if they may make less money with that product or investment strategy. In other words, they are beholden to give honest, impartial recommendations to their clients, and may face sanctions by the CFP Board if found to violate its Code of Ethics and Standards of Conduct, which includes failure to act in a fiduciary duty.5

CFPs evaluate your total financial picture, such as investments, insurance policies, and overall current financial position, to develop a comprehensive strategy that will successfully guide you to your financial goal. There are many individuals who may refer to themselves as financial planners without having the CFP designation; while they may offer similar services as above, they will not be required to act as a fiduciary. Hence, it is important to do your due diligence and verify they hold this certification via the CFP Board website: www.cfp.net/verify-a-cfp-professional.

An investment adviser is a legal term from the U.S. Securities and Exchange Commission (SEC) and the Financial Industry Regulatory Authority (FINRA) referring to an individual who provides recommendations and analyses for financial securities such as stock. Both of these agencies ensure investment advisers adhere to regulatory requirements designed to protect client investers. Similar to CFPs, they are held to a fiduciary standard, and their firm is required to register with the SEC or the state of practice based on the amount of assets under management.6

An individual investment adviser must also register with their state as an Investment Adviser Representative (IAR), the distinctive term referring to an individual as opposed to an investment advising firm. Investment advisers are required to pass the extensive Series 65, Uniform Investment Advisor Law Exam, or equivalent, by states requiring licensure.7 They can guide you on the selection of particular investments and portfolio management based on a discussion with you regarding your current financial standing and what fiscal ambitions you wish to achieve.

A financial adviser provides direction on a multitude of financially related topics such as investing, tax laws, and life insurance with the goal to help you reach specific financial objectives. However, this term is often used quite ubiquitously given the lack of formal regulation of the title. Essentially, those with varying types of educational background can give themselves the title of financial adviser.

If a financial adviser buys or sells financial securities such as stocks or bonds, then they must be registered as a licensed broker with the SEC and IAR and pass the Series 6 or Series 7 exam. Unlike CFPs and investment advisers, a financial adviser (if also a licensed broker) is not required to be a fiduciary, and instead works under the suitability standard.8 Suitability requires that financial recommendations made by the adviser are appropriate but not necessarily the best for the client. In fact, these recommendations do not even have to be the most suitable. This is where conflicts of interest can arise with the adviser recommending products and securities that best compensate them while not serving the best return on investment for you.

Making the search for a financial adviser more complex, an individual can be a combination of any of the above, pending the appropriate licensing. For example, a CFP can also be an asset manager and thus hold the title of a financial adviser and/or IAR. A financial adviser may also not directly manage your assets if they have a partnership with a third party or another licensed individual. Questions to ask of your potential financial adviser should therefore include the following:

- What licensure and related education do you have?

- What is your particular area of expertise?

- How long have you been in practice?

- How will you be managing my assets?

Financial Adviser Fee Schedules

Prior to working with a financial adviser, you must also inquire about their fee structure. There are two kinds of fee schedules used by financial advisers: fee-only and fee-based.

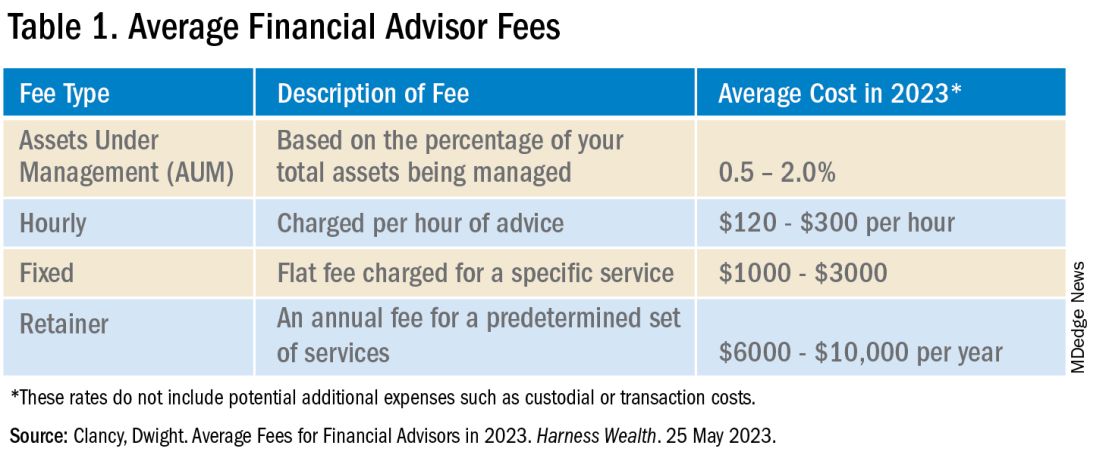

Fee-only advisers receive payment solely for the services they provide. They do not collect commissions from third parties providing the recommended products. There is variability in how this type of payment schedule is structured, encompassing flat fees, hourly rates, or the adviser charging a retainer. The Table below compares the types of fee-only structures and range of charges based on 2023 rates.9 Of note, fee-only advisers serve as fiduciaries.10

Fee-based financial advisers receive payment for services but may also receive commission on specific products they sell to you.9 Most, if not all, financial experts recommend avoiding advisers using commission-based charges given the potential conflict of interest: How can one be absolutely sure this recommended financial product is best for you, knowing your adviser has a financial stake in said item?

In addition to charging the fees above, your financial adviser, if they are actively managing your investment portfolio, will also charge an assets under management (AUM) fee. This is a percentage of the dollar amount within your portfolio. For example, if your adviser charges a 1% AUM rate for your account totaling $100,000, this equates to a $1,000 fee in that calendar year. AUM fees typically decrease as the size of your portfolio increases. As seen in the Table, there is a wide range of the average AUM rate (0.5%–2%); however, an AUM fee approaching 2% is unnecessarily high and consumes a significant portion of your portfolio. Thus, it is recommended to look for a money manager with an approximate 1% AUM fee.

Many of us delay or avoid working with a financial adviser due to the potential perceived risks of having poor portfolio management from an adviser not working in our best interest, along with the concern for excessive fees. In many ways, it is how we counsel our patients. While they can seek medical information on their own, their best care is under the guidance of an expert: a healthcare professional. That being said, personal finance is indeed personal, so I hope this guide helps facilitate your search and increase your financial wellness.

Dr. Luthra is a therapeutic endoscopist at Moffitt Cancer Center, Tampa, Florida, and the founder of The Scope of Finance, a financial wellness education and coaching company focused on physicians. Her interest in financial well-being is thanks to the teachings of her father, an entrepreneur and former Certified Financial Planner (CFP). She can be found on Instagram (thescopeoffinance) and X (@ScopeofFinance). She reports no financial disclosures relevant to this article.

References

1. Pagliaro CA and Utkus SP. Assessing the value of advice. Vanguard. 2019 Sept.

2. Kinniry Jr. FM et al. Putting a value on your value: Quantifying Vanguard Advisor’s Alpha. Vanguard. 2022 July.

3. Horan S. What Are the Benefits of Working with a Financial Advisor? – 2021 Study. Smart Asset. 2023 July 27.

4. Kagan J. Certified Financial PlannerTM(CFP): What It Is and How to Become One. Investopedia. 2023 Aug 3.

5. CFP Board. Our Commitment to Ethical Standards. CFP Board. 2024.

6. Staff of the Investment Adviser Regulation Office Division of Investment Management, U.S. Securities and Exchange Commission. Regulation of Investment Advisers by the U.S. Securities and Exchange Commission. 2013 Mar.

7. Hicks C. Investment Advisor vs. Financial Advisor: There is a Difference. US News & World Report. 2019 June 13.

8. Roberts K. Financial advisor vs. financial planner: What is the difference? Bankrate. 2023 Nov 21.

9. Clancy D. Average Fees for Financial Advisors in 2023. Harness Wealth. 2023 May 25.

10. Palmer B. Fee- vs. Commission-Based Advisor: What’s the Difference? Investopedia. 2023 June 20.

As gastroenterologists, we spend innumerable years in medical training with an abrupt and significant increase in our earning potential upon beginning practice. The majority of us also carry a sizeable amount of student loan debt. This combination results in a unique situation that can make us hesitant about how best to set ourselves up financially while also making us vulnerable to potentially predatory financial practices.

Although your initial steps to achieve financial wellness and build wealth can be obtained on your own with some education, a financial adviser becomes indispensable when you have significant assets, a high income, complex finances, and/or are experiencing a major life change. Additionally, as there are so many avenues to invest and grow your capital, a financial adviser can assist in designing a portfolio to best accomplish specific monetary goals. Studies have demonstrated that those working with a financial adviser reduce their single-stock risk and have more significant increase in portfolio value, reducing the total cost associated with their investments’ management.1 Those working with a financial adviser will also net up to a 3% larger annual return, compared with a standard baseline investment plan.2,3

Based on this information, it may appear that working with a personal financial adviser would be a no-brainer. Unfortunately, there is a caveat: There is no legal regulation regarding who can use the title “financial adviser.” It is therefore crucial to be aware of common practices and terminology to best help you identify a reputable financial adviser and reduce your risk of excessive fees or financial loss. This is also a highly personal decision and your search should first begin with understanding why you are looking for an adviser, as this will determine the appropriate type of service to look for.

Types of Advisers

A certified financial planner (CFP) is an expert in estate planning, taxes, retirement saving, and financial planning who has a formal designation by the Certified Financial Planner Board of Standards Inc.4 They must undergo stringent licensing examinations following a 3-year course with required continuing education to maintain their credentials. CFPs are fiduciaries, meaning they must make financial decisions in your best interest, even if they may make less money with that product or investment strategy. In other words, they are beholden to give honest, impartial recommendations to their clients, and may face sanctions by the CFP Board if found to violate its Code of Ethics and Standards of Conduct, which includes failure to act in a fiduciary duty.5

CFPs evaluate your total financial picture, such as investments, insurance policies, and overall current financial position, to develop a comprehensive strategy that will successfully guide you to your financial goal. There are many individuals who may refer to themselves as financial planners without having the CFP designation; while they may offer similar services as above, they will not be required to act as a fiduciary. Hence, it is important to do your due diligence and verify they hold this certification via the CFP Board website: www.cfp.net/verify-a-cfp-professional.

An investment adviser is a legal term from the U.S. Securities and Exchange Commission (SEC) and the Financial Industry Regulatory Authority (FINRA) referring to an individual who provides recommendations and analyses for financial securities such as stock. Both of these agencies ensure investment advisers adhere to regulatory requirements designed to protect client investers. Similar to CFPs, they are held to a fiduciary standard, and their firm is required to register with the SEC or the state of practice based on the amount of assets under management.6

An individual investment adviser must also register with their state as an Investment Adviser Representative (IAR), the distinctive term referring to an individual as opposed to an investment advising firm. Investment advisers are required to pass the extensive Series 65, Uniform Investment Advisor Law Exam, or equivalent, by states requiring licensure.7 They can guide you on the selection of particular investments and portfolio management based on a discussion with you regarding your current financial standing and what fiscal ambitions you wish to achieve.

A financial adviser provides direction on a multitude of financially related topics such as investing, tax laws, and life insurance with the goal to help you reach specific financial objectives. However, this term is often used quite ubiquitously given the lack of formal regulation of the title. Essentially, those with varying types of educational background can give themselves the title of financial adviser.

If a financial adviser buys or sells financial securities such as stocks or bonds, then they must be registered as a licensed broker with the SEC and IAR and pass the Series 6 or Series 7 exam. Unlike CFPs and investment advisers, a financial adviser (if also a licensed broker) is not required to be a fiduciary, and instead works under the suitability standard.8 Suitability requires that financial recommendations made by the adviser are appropriate but not necessarily the best for the client. In fact, these recommendations do not even have to be the most suitable. This is where conflicts of interest can arise with the adviser recommending products and securities that best compensate them while not serving the best return on investment for you.

Making the search for a financial adviser more complex, an individual can be a combination of any of the above, pending the appropriate licensing. For example, a CFP can also be an asset manager and thus hold the title of a financial adviser and/or IAR. A financial adviser may also not directly manage your assets if they have a partnership with a third party or another licensed individual. Questions to ask of your potential financial adviser should therefore include the following:

- What licensure and related education do you have?

- What is your particular area of expertise?

- How long have you been in practice?

- How will you be managing my assets?

Financial Adviser Fee Schedules

Prior to working with a financial adviser, you must also inquire about their fee structure. There are two kinds of fee schedules used by financial advisers: fee-only and fee-based.

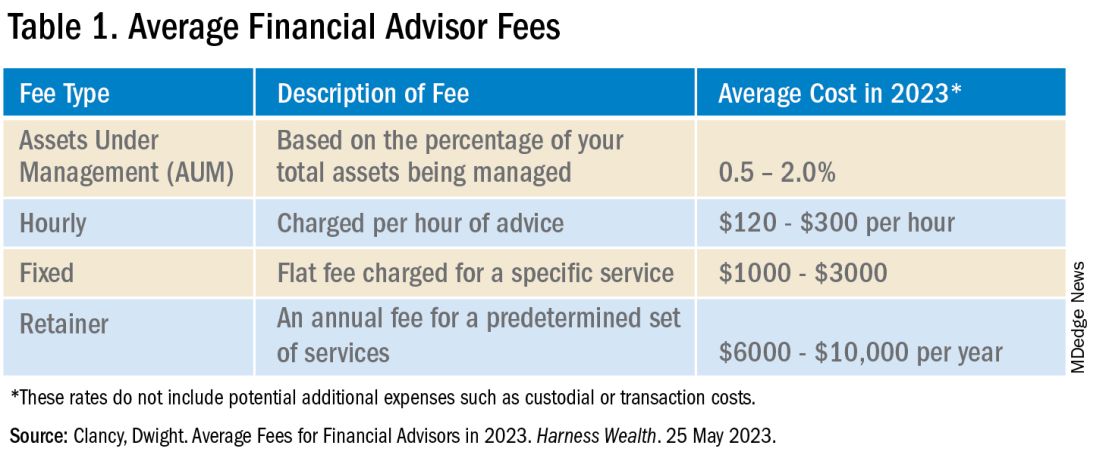

Fee-only advisers receive payment solely for the services they provide. They do not collect commissions from third parties providing the recommended products. There is variability in how this type of payment schedule is structured, encompassing flat fees, hourly rates, or the adviser charging a retainer. The Table below compares the types of fee-only structures and range of charges based on 2023 rates.9 Of note, fee-only advisers serve as fiduciaries.10

Fee-based financial advisers receive payment for services but may also receive commission on specific products they sell to you.9 Most, if not all, financial experts recommend avoiding advisers using commission-based charges given the potential conflict of interest: How can one be absolutely sure this recommended financial product is best for you, knowing your adviser has a financial stake in said item?

In addition to charging the fees above, your financial adviser, if they are actively managing your investment portfolio, will also charge an assets under management (AUM) fee. This is a percentage of the dollar amount within your portfolio. For example, if your adviser charges a 1% AUM rate for your account totaling $100,000, this equates to a $1,000 fee in that calendar year. AUM fees typically decrease as the size of your portfolio increases. As seen in the Table, there is a wide range of the average AUM rate (0.5%–2%); however, an AUM fee approaching 2% is unnecessarily high and consumes a significant portion of your portfolio. Thus, it is recommended to look for a money manager with an approximate 1% AUM fee.

Many of us delay or avoid working with a financial adviser due to the potential perceived risks of having poor portfolio management from an adviser not working in our best interest, along with the concern for excessive fees. In many ways, it is how we counsel our patients. While they can seek medical information on their own, their best care is under the guidance of an expert: a healthcare professional. That being said, personal finance is indeed personal, so I hope this guide helps facilitate your search and increase your financial wellness.

Dr. Luthra is a therapeutic endoscopist at Moffitt Cancer Center, Tampa, Florida, and the founder of The Scope of Finance, a financial wellness education and coaching company focused on physicians. Her interest in financial well-being is thanks to the teachings of her father, an entrepreneur and former Certified Financial Planner (CFP). She can be found on Instagram (thescopeoffinance) and X (@ScopeofFinance). She reports no financial disclosures relevant to this article.

References

1. Pagliaro CA and Utkus SP. Assessing the value of advice. Vanguard. 2019 Sept.

2. Kinniry Jr. FM et al. Putting a value on your value: Quantifying Vanguard Advisor’s Alpha. Vanguard. 2022 July.

3. Horan S. What Are the Benefits of Working with a Financial Advisor? – 2021 Study. Smart Asset. 2023 July 27.

4. Kagan J. Certified Financial PlannerTM(CFP): What It Is and How to Become One. Investopedia. 2023 Aug 3.

5. CFP Board. Our Commitment to Ethical Standards. CFP Board. 2024.

6. Staff of the Investment Adviser Regulation Office Division of Investment Management, U.S. Securities and Exchange Commission. Regulation of Investment Advisers by the U.S. Securities and Exchange Commission. 2013 Mar.

7. Hicks C. Investment Advisor vs. Financial Advisor: There is a Difference. US News & World Report. 2019 June 13.

8. Roberts K. Financial advisor vs. financial planner: What is the difference? Bankrate. 2023 Nov 21.

9. Clancy D. Average Fees for Financial Advisors in 2023. Harness Wealth. 2023 May 25.

10. Palmer B. Fee- vs. Commission-Based Advisor: What’s the Difference? Investopedia. 2023 June 20.