User login

You are trying to buy your first home. Maybe you have heard stories from family, friends, and colleagues about nightmare scenarios when purchasing a home. There are many facets to the home-financing process, and a little bit of planning can reduce a significant amount of time and stress. Where do you begin? What do lenders look for when preapproving a borrower? What steps do I take to get preapproved for a mortgage loan? This article will help guide you through these initial stages to ultimately guide you to settlement on your new home.

Where to begin?

- Start by drafting a budget. How much of a monthly housing payment can you afford? Planning a budget is an extremely valuable exercise at any point in life, not just when buying a home. Often, borrowers will ask the question “How much can I afford?” The better question to ask is “Can I qualify for a home that meets the maximum monthly payment I have budgeted for?”

- What funds would I use for purchasing a home? Down payments and closing costs can add up quickly. Do you have funds readily available in an account you hold? Will you be obtaining a gift from a family member? Generally, funds for down payment are not allowed to be borrowed, unless the money is coming from an account secured by your own assets (for instance, borrowing from your own retirement account). Don’t think you necessarily need to put 20% down. Some loan programs offer little or no down payment options, while other programs may offer down payment assistance options.

- If you are not aware of your credit standing, run a free credit report to verify accurate information. Federal law allows consumers to access one free credit report annually with each of the three credit bureaus (Equifax, Experian, TransUnion). Knowing your credit history and data on your credit report is very important. If there are known or unknown issues on your credit report, it’s always best to at least be informed. You can access your free report at www.annualcreditreport.com.

- Start planning ahead with some of the documentation you will need for a loan approval. Lenders will request items such as tax returns and W-2s from the past 2 years, your recent pay stubs covering a 30-day period, most recent 2 months asset account statements (bank accounts, investment accounts, retirement accounts, etc.), as well as other documentation, depending on your specific scenario.

What are lenders looking at when preapproving an applicant?

Many people will often start to search for homes without having prepared for the preapproval process. This is not necessarily an issue and it doesn’t mean you will not be preapproved. Planning ahead could help you avoid any unforeseen problems and avoid rushing into the mortgage application process when trying to place an offer on a home.

In addition to supplying information on residence and employment/student history for the past 2 years, there are three primary components to a borrower’s credit portfolio:

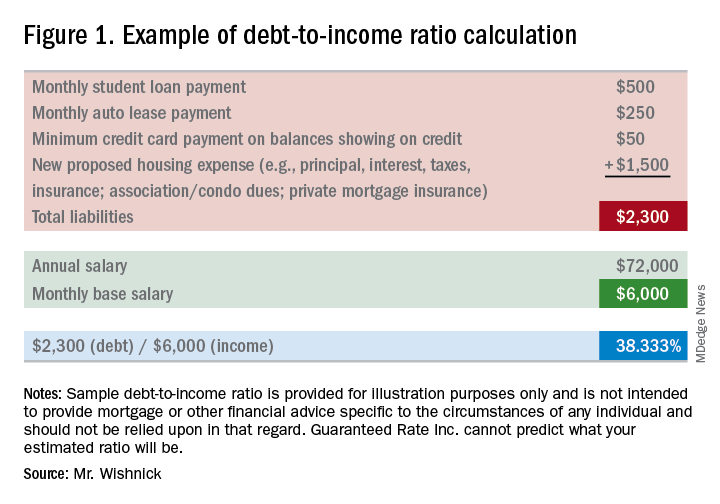

1) Debt-to-income ratio: What monthly expenses will show on your credit report (car loans/leases, student loans, credit card payments, personal loans/lines of credit, and mortgages for other properties owned)? Do you own any other real estate? Do you have other required obligations, such as alimony or child support payments? To calculate, first combine these liabilities on a monthly expense basis along with the new proposed monthly housing payment. Take these monthly liabilities and divide by monthly income. Gross income (pretax) for employees of a company they do not own is typically utilized (bonus or commission income can have some alternate rules to be allowed as qualifying income); for self-employed borrowers, tax returns will be required to be reviewed; tax write offs could reduce qualifying income. Self-employed individuals will typically need to show a 2-year income history via personal tax returns (as well as business tax returns if applicable). See Figure 1 for an example of a debt-to-income ratio calculation. Many loan programs will require a debt-to-income ratio of 45% or less. There are various loan programs that will be more or less restrictive than this percentage. A lender will be able to guide you to the proper program for your scenario.

2) Liquid assets: Lenders will review the amount of liquid funds you have available for down payment, closing costs, and any necessary reserves. These may include, but are not limited to, checking/savings/money market accounts, investment accounts (stocks, bonds, mutual funds), and retirement funds. Are there enough allowable funds available for the down payment and closing costs, as well as any required reserves needed for qualification? Large non–payroll deposits can be required to be sourced to make sure the funds are from an allowable source.

3) Credit history/scores: Buying a home will be one of the largest purchases you will make in a lifetime. Credit scores have a major impact on the cost of credit (the interest rate you will obtain). Having higher scores could result in a lower interest rate, as well as open up certain loan programs that may be more advantageous for you. Oftentimes, lenders will take the middle of the three scores as your mortgage score (one score from each of the three credit bureaus). In most cases, if applying jointly, the lowest of the middle scores for all borrowers is the score that is used as the score for the applicants. In general, a 740 middle credit score is considered to be excellent for mortgage financing but is not a requirement for all programs.

**You may have heard about specific mortgage programs for physicians. These programs are intended for use for lesser down payments, and/or not calculating student loan payments when qualifying for home financing. As future income potential is typically not considered when determining debt-to-income ratios, not counting these liabilities potentially increases borrowing power.

You are now ready to be preapproved for mortgage financing. What should you do next?

- Talk to a trusted lender. Ask your real estate agent, family, friends, or colleagues for local lender recommendations. Real estate agents will want to make sure you have spoken with a lender and completed a preapproval application to ensure that you can be preapproved for financing before showing you homes. If you need a loan to purchase a home, a preapproval letter will be required to submit with an offer letter. The application contains questions such as your address and employment history for the past 2 years, income and asset information, as well as a series of other financial information. A hard credit inquiry will need to be performed in order for the lender to issue a preapproval. What should you expect from a lender in addition to competitive rates and an array of programs? Some people prefer more of a hands-on approach. Working with a lender who provides regular status updates and makes him/herself easily accessible for all of your questions can certainly be an attractive feature. Working with a local lender also may be reassuring, as he or she should have plenty of experience with the market in which you are purchasing.

- Search for homes. Upon being given the green light for your preapproval and a price range within your comfort zone, connect with your local real estate professional to search for homes. Plan to spend time with your agent discussing all your needs for your new home.

- Submit an offer. Your lender will be able to provide an estimate of closing costs and monthly payments for homes that you are considering buying before you make an offer. You will want to be sure you are comfortable with the financial obligation prior to making your offer. With your offer, an initial good faith deposit (earnest money deposit) will be required. Your real estate agent will guide you on the proper amount of the deposit.

Conclusion

Once you and the seller have come to terms, you will look to discuss with your lender the rate and program options to secure (locking in an interest rate and program), as well as to complete the formal mortgage application. The lender will request additional documentation, if you have not already provided documents, in order for you to obtain a conditional mortgage commitment. The lender also will order an appraisal to ensure the property value supports the price you have agreed to pay for it. Your real estate agent will guide you through the various deadlines and requirements in the contract for items like home inspections, ordering a title search to obtain title insurance, and other nonfinancing contingencies. Some areas may require attorneys for contract review and closing, which your agent will discuss with you. As you can see, buying a home is not an instant process. Taking the appropriate steps to prepare for your mortgage preapproval could save you a lot of time and stress.

Mr. Wishnick is a 15-year mortgage industry veteran, vice president of mortgage lending with Guaranteed Rate (NMLS #2611) and was ranked as a Top 1% mortgage originator by Mortgage Executive Magazine. He can be reached at rob.wishnick@rate.com.

All information provided in this publication is for informational and educational purposes only, and in no way is any of the content contained herein to be construed as financial, investment, or legal advice or instruction. Guaranteed Rate does not guarantee the quality, accuracy, completeness or timelines of the information in this publication.

You are trying to buy your first home. Maybe you have heard stories from family, friends, and colleagues about nightmare scenarios when purchasing a home. There are many facets to the home-financing process, and a little bit of planning can reduce a significant amount of time and stress. Where do you begin? What do lenders look for when preapproving a borrower? What steps do I take to get preapproved for a mortgage loan? This article will help guide you through these initial stages to ultimately guide you to settlement on your new home.

Where to begin?

- Start by drafting a budget. How much of a monthly housing payment can you afford? Planning a budget is an extremely valuable exercise at any point in life, not just when buying a home. Often, borrowers will ask the question “How much can I afford?” The better question to ask is “Can I qualify for a home that meets the maximum monthly payment I have budgeted for?”

- What funds would I use for purchasing a home? Down payments and closing costs can add up quickly. Do you have funds readily available in an account you hold? Will you be obtaining a gift from a family member? Generally, funds for down payment are not allowed to be borrowed, unless the money is coming from an account secured by your own assets (for instance, borrowing from your own retirement account). Don’t think you necessarily need to put 20% down. Some loan programs offer little or no down payment options, while other programs may offer down payment assistance options.

- If you are not aware of your credit standing, run a free credit report to verify accurate information. Federal law allows consumers to access one free credit report annually with each of the three credit bureaus (Equifax, Experian, TransUnion). Knowing your credit history and data on your credit report is very important. If there are known or unknown issues on your credit report, it’s always best to at least be informed. You can access your free report at www.annualcreditreport.com.

- Start planning ahead with some of the documentation you will need for a loan approval. Lenders will request items such as tax returns and W-2s from the past 2 years, your recent pay stubs covering a 30-day period, most recent 2 months asset account statements (bank accounts, investment accounts, retirement accounts, etc.), as well as other documentation, depending on your specific scenario.

What are lenders looking at when preapproving an applicant?

Many people will often start to search for homes without having prepared for the preapproval process. This is not necessarily an issue and it doesn’t mean you will not be preapproved. Planning ahead could help you avoid any unforeseen problems and avoid rushing into the mortgage application process when trying to place an offer on a home.

In addition to supplying information on residence and employment/student history for the past 2 years, there are three primary components to a borrower’s credit portfolio:

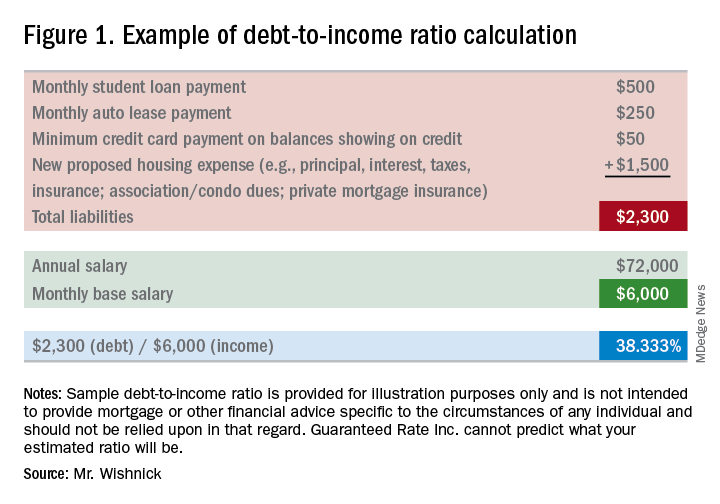

1) Debt-to-income ratio: What monthly expenses will show on your credit report (car loans/leases, student loans, credit card payments, personal loans/lines of credit, and mortgages for other properties owned)? Do you own any other real estate? Do you have other required obligations, such as alimony or child support payments? To calculate, first combine these liabilities on a monthly expense basis along with the new proposed monthly housing payment. Take these monthly liabilities and divide by monthly income. Gross income (pretax) for employees of a company they do not own is typically utilized (bonus or commission income can have some alternate rules to be allowed as qualifying income); for self-employed borrowers, tax returns will be required to be reviewed; tax write offs could reduce qualifying income. Self-employed individuals will typically need to show a 2-year income history via personal tax returns (as well as business tax returns if applicable). See Figure 1 for an example of a debt-to-income ratio calculation. Many loan programs will require a debt-to-income ratio of 45% or less. There are various loan programs that will be more or less restrictive than this percentage. A lender will be able to guide you to the proper program for your scenario.

2) Liquid assets: Lenders will review the amount of liquid funds you have available for down payment, closing costs, and any necessary reserves. These may include, but are not limited to, checking/savings/money market accounts, investment accounts (stocks, bonds, mutual funds), and retirement funds. Are there enough allowable funds available for the down payment and closing costs, as well as any required reserves needed for qualification? Large non–payroll deposits can be required to be sourced to make sure the funds are from an allowable source.

3) Credit history/scores: Buying a home will be one of the largest purchases you will make in a lifetime. Credit scores have a major impact on the cost of credit (the interest rate you will obtain). Having higher scores could result in a lower interest rate, as well as open up certain loan programs that may be more advantageous for you. Oftentimes, lenders will take the middle of the three scores as your mortgage score (one score from each of the three credit bureaus). In most cases, if applying jointly, the lowest of the middle scores for all borrowers is the score that is used as the score for the applicants. In general, a 740 middle credit score is considered to be excellent for mortgage financing but is not a requirement for all programs.

**You may have heard about specific mortgage programs for physicians. These programs are intended for use for lesser down payments, and/or not calculating student loan payments when qualifying for home financing. As future income potential is typically not considered when determining debt-to-income ratios, not counting these liabilities potentially increases borrowing power.

You are now ready to be preapproved for mortgage financing. What should you do next?

- Talk to a trusted lender. Ask your real estate agent, family, friends, or colleagues for local lender recommendations. Real estate agents will want to make sure you have spoken with a lender and completed a preapproval application to ensure that you can be preapproved for financing before showing you homes. If you need a loan to purchase a home, a preapproval letter will be required to submit with an offer letter. The application contains questions such as your address and employment history for the past 2 years, income and asset information, as well as a series of other financial information. A hard credit inquiry will need to be performed in order for the lender to issue a preapproval. What should you expect from a lender in addition to competitive rates and an array of programs? Some people prefer more of a hands-on approach. Working with a lender who provides regular status updates and makes him/herself easily accessible for all of your questions can certainly be an attractive feature. Working with a local lender also may be reassuring, as he or she should have plenty of experience with the market in which you are purchasing.

- Search for homes. Upon being given the green light for your preapproval and a price range within your comfort zone, connect with your local real estate professional to search for homes. Plan to spend time with your agent discussing all your needs for your new home.

- Submit an offer. Your lender will be able to provide an estimate of closing costs and monthly payments for homes that you are considering buying before you make an offer. You will want to be sure you are comfortable with the financial obligation prior to making your offer. With your offer, an initial good faith deposit (earnest money deposit) will be required. Your real estate agent will guide you on the proper amount of the deposit.

Conclusion

Once you and the seller have come to terms, you will look to discuss with your lender the rate and program options to secure (locking in an interest rate and program), as well as to complete the formal mortgage application. The lender will request additional documentation, if you have not already provided documents, in order for you to obtain a conditional mortgage commitment. The lender also will order an appraisal to ensure the property value supports the price you have agreed to pay for it. Your real estate agent will guide you through the various deadlines and requirements in the contract for items like home inspections, ordering a title search to obtain title insurance, and other nonfinancing contingencies. Some areas may require attorneys for contract review and closing, which your agent will discuss with you. As you can see, buying a home is not an instant process. Taking the appropriate steps to prepare for your mortgage preapproval could save you a lot of time and stress.

Mr. Wishnick is a 15-year mortgage industry veteran, vice president of mortgage lending with Guaranteed Rate (NMLS #2611) and was ranked as a Top 1% mortgage originator by Mortgage Executive Magazine. He can be reached at rob.wishnick@rate.com.

All information provided in this publication is for informational and educational purposes only, and in no way is any of the content contained herein to be construed as financial, investment, or legal advice or instruction. Guaranteed Rate does not guarantee the quality, accuracy, completeness or timelines of the information in this publication.

You are trying to buy your first home. Maybe you have heard stories from family, friends, and colleagues about nightmare scenarios when purchasing a home. There are many facets to the home-financing process, and a little bit of planning can reduce a significant amount of time and stress. Where do you begin? What do lenders look for when preapproving a borrower? What steps do I take to get preapproved for a mortgage loan? This article will help guide you through these initial stages to ultimately guide you to settlement on your new home.

Where to begin?

- Start by drafting a budget. How much of a monthly housing payment can you afford? Planning a budget is an extremely valuable exercise at any point in life, not just when buying a home. Often, borrowers will ask the question “How much can I afford?” The better question to ask is “Can I qualify for a home that meets the maximum monthly payment I have budgeted for?”

- What funds would I use for purchasing a home? Down payments and closing costs can add up quickly. Do you have funds readily available in an account you hold? Will you be obtaining a gift from a family member? Generally, funds for down payment are not allowed to be borrowed, unless the money is coming from an account secured by your own assets (for instance, borrowing from your own retirement account). Don’t think you necessarily need to put 20% down. Some loan programs offer little or no down payment options, while other programs may offer down payment assistance options.

- If you are not aware of your credit standing, run a free credit report to verify accurate information. Federal law allows consumers to access one free credit report annually with each of the three credit bureaus (Equifax, Experian, TransUnion). Knowing your credit history and data on your credit report is very important. If there are known or unknown issues on your credit report, it’s always best to at least be informed. You can access your free report at www.annualcreditreport.com.

- Start planning ahead with some of the documentation you will need for a loan approval. Lenders will request items such as tax returns and W-2s from the past 2 years, your recent pay stubs covering a 30-day period, most recent 2 months asset account statements (bank accounts, investment accounts, retirement accounts, etc.), as well as other documentation, depending on your specific scenario.

What are lenders looking at when preapproving an applicant?

Many people will often start to search for homes without having prepared for the preapproval process. This is not necessarily an issue and it doesn’t mean you will not be preapproved. Planning ahead could help you avoid any unforeseen problems and avoid rushing into the mortgage application process when trying to place an offer on a home.

In addition to supplying information on residence and employment/student history for the past 2 years, there are three primary components to a borrower’s credit portfolio:

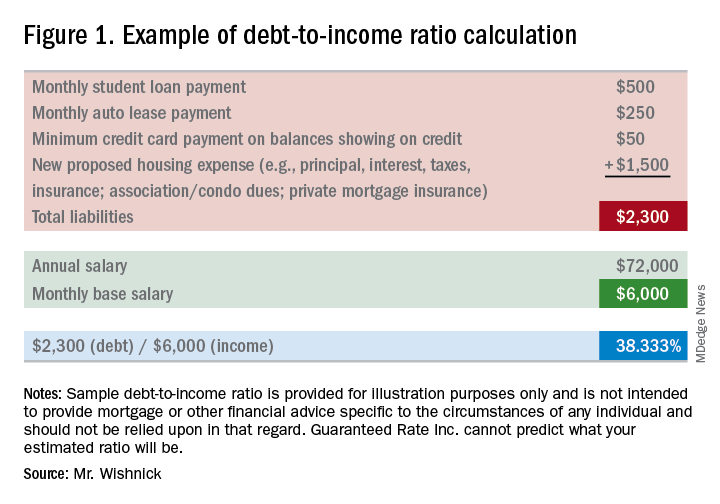

1) Debt-to-income ratio: What monthly expenses will show on your credit report (car loans/leases, student loans, credit card payments, personal loans/lines of credit, and mortgages for other properties owned)? Do you own any other real estate? Do you have other required obligations, such as alimony or child support payments? To calculate, first combine these liabilities on a monthly expense basis along with the new proposed monthly housing payment. Take these monthly liabilities and divide by monthly income. Gross income (pretax) for employees of a company they do not own is typically utilized (bonus or commission income can have some alternate rules to be allowed as qualifying income); for self-employed borrowers, tax returns will be required to be reviewed; tax write offs could reduce qualifying income. Self-employed individuals will typically need to show a 2-year income history via personal tax returns (as well as business tax returns if applicable). See Figure 1 for an example of a debt-to-income ratio calculation. Many loan programs will require a debt-to-income ratio of 45% or less. There are various loan programs that will be more or less restrictive than this percentage. A lender will be able to guide you to the proper program for your scenario.

2) Liquid assets: Lenders will review the amount of liquid funds you have available for down payment, closing costs, and any necessary reserves. These may include, but are not limited to, checking/savings/money market accounts, investment accounts (stocks, bonds, mutual funds), and retirement funds. Are there enough allowable funds available for the down payment and closing costs, as well as any required reserves needed for qualification? Large non–payroll deposits can be required to be sourced to make sure the funds are from an allowable source.

3) Credit history/scores: Buying a home will be one of the largest purchases you will make in a lifetime. Credit scores have a major impact on the cost of credit (the interest rate you will obtain). Having higher scores could result in a lower interest rate, as well as open up certain loan programs that may be more advantageous for you. Oftentimes, lenders will take the middle of the three scores as your mortgage score (one score from each of the three credit bureaus). In most cases, if applying jointly, the lowest of the middle scores for all borrowers is the score that is used as the score for the applicants. In general, a 740 middle credit score is considered to be excellent for mortgage financing but is not a requirement for all programs.

**You may have heard about specific mortgage programs for physicians. These programs are intended for use for lesser down payments, and/or not calculating student loan payments when qualifying for home financing. As future income potential is typically not considered when determining debt-to-income ratios, not counting these liabilities potentially increases borrowing power.

You are now ready to be preapproved for mortgage financing. What should you do next?

- Talk to a trusted lender. Ask your real estate agent, family, friends, or colleagues for local lender recommendations. Real estate agents will want to make sure you have spoken with a lender and completed a preapproval application to ensure that you can be preapproved for financing before showing you homes. If you need a loan to purchase a home, a preapproval letter will be required to submit with an offer letter. The application contains questions such as your address and employment history for the past 2 years, income and asset information, as well as a series of other financial information. A hard credit inquiry will need to be performed in order for the lender to issue a preapproval. What should you expect from a lender in addition to competitive rates and an array of programs? Some people prefer more of a hands-on approach. Working with a lender who provides regular status updates and makes him/herself easily accessible for all of your questions can certainly be an attractive feature. Working with a local lender also may be reassuring, as he or she should have plenty of experience with the market in which you are purchasing.

- Search for homes. Upon being given the green light for your preapproval and a price range within your comfort zone, connect with your local real estate professional to search for homes. Plan to spend time with your agent discussing all your needs for your new home.

- Submit an offer. Your lender will be able to provide an estimate of closing costs and monthly payments for homes that you are considering buying before you make an offer. You will want to be sure you are comfortable with the financial obligation prior to making your offer. With your offer, an initial good faith deposit (earnest money deposit) will be required. Your real estate agent will guide you on the proper amount of the deposit.

Conclusion

Once you and the seller have come to terms, you will look to discuss with your lender the rate and program options to secure (locking in an interest rate and program), as well as to complete the formal mortgage application. The lender will request additional documentation, if you have not already provided documents, in order for you to obtain a conditional mortgage commitment. The lender also will order an appraisal to ensure the property value supports the price you have agreed to pay for it. Your real estate agent will guide you through the various deadlines and requirements in the contract for items like home inspections, ordering a title search to obtain title insurance, and other nonfinancing contingencies. Some areas may require attorneys for contract review and closing, which your agent will discuss with you. As you can see, buying a home is not an instant process. Taking the appropriate steps to prepare for your mortgage preapproval could save you a lot of time and stress.

Mr. Wishnick is a 15-year mortgage industry veteran, vice president of mortgage lending with Guaranteed Rate (NMLS #2611) and was ranked as a Top 1% mortgage originator by Mortgage Executive Magazine. He can be reached at rob.wishnick@rate.com.

All information provided in this publication is for informational and educational purposes only, and in no way is any of the content contained herein to be construed as financial, investment, or legal advice or instruction. Guaranteed Rate does not guarantee the quality, accuracy, completeness or timelines of the information in this publication.